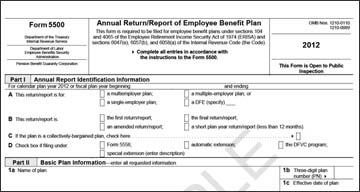

ERISA plans with 100 or more participants at the beginning of the plan year are required to file a Form 5500. An ERISA financial audit may also be required.

ERISA plans with 100 or more participants at the beginning of the plan year are required to file a Form 5500. An ERISA financial audit may also be required.

Small plans with less than 100 participants at the beginning of the plan year may be eligible to file Form 5500-SF.

Certain welfare benefit plans with less than 100 participants at the beginning of the plan year may be exempt from filing Form 5500.

The Form 5500 must be filled no later than 7 months (or up to 9 1/2 months with extensions) after the end of the plan year. A two and one half month extension may be obtained by filing Form 5558 with the IRS.

Penalties for not filing a Form 5500 can be up to $1,100 per day for failure or refusal to file a Form 5500.

If you discover that you have not filed all your Forms 5500, do not wait for the government to find you! Take advantage of the Delinquent Filer Voluntary Compliance Program. We can help.

We are available to prepare your annual Form 5500 and Summary Annual Report.

If you would rather do it yourself, we are available to review your Form 5500 or train your staff in preparing the Form 5500.

Common questions regarding Form 5500

Form 5500 FAQs

Do I have to file a Form 5500 for each of my health and welfare plans?

That depends on how you define “plan”. Many employers refer to their various welfare plan coverages (medical, dental, life etc.) as one plan. In this case, you can file one Form 5500 for the “plan” provided you have a wrap plan document to support the one plan concept.

When do I really have to file a Form 5500 for my welfare plans?

Once again, that depends on how you define “plan”. If you define each coverage (e.g., medical, dental, life, etc.) as a separate plan with a separate plan number, you would file a Form 5500 when there are 100 participants at the beginning of the plan year unless your plan is what is called “funded”.

If you define your “plan” as one plan encompassing all your welfare benefit offerings and utilize a wrap plan document, you would file a Form 5500 as soon as one of the benefit offerings had 100 participants at the beginning of the plan year.

How do you define participant?

The Form 5500 instructions define “participant” for purposes of filing a Form 5500 as follows:

An individual becomes a participant covered under an employee welfare benefit plan on the earliest of:

- The date designated by the plan as the date on which the individual begins participation in the plan;

- The date on which the individual becomes eligible under the plan for a benefit subject only to occurrence of the contingency for which the benefit is provided; or

- The date on which the individual makes a contribution to the plan, whether voluntary or mandatory.

Practically speaking, many employers automatically provide life insurance to employees. As a result, the life insurance coverage may reach 100 participants before any other coverage. If you treat your coverages as separate plans, a Form 5500 would be required for the life insurance. If you “wrap” your coverages into one plan, as soon as one coverage reaches 100 participants, a Form 5500 is required for the “plan” even if this means attaching Schedules A for coverages with less than 100 participants.